The Six Biggest Challenges of Traditional Audit Techniques

Ritika Jain

Oct 30, 2024

Once considered valid, traditional audit techniques are now being scrutinized due to their limitations in today's fast-paced regulatory environment. As compliance and regulatory frameworks continue to evolve and grow, the need for efficient and effective audit techniques has become more pressing than ever. Despite their limitations and challenges, traditional audit techniques are still widely used.

In this blog, we will examine the significant challenges of traditional auditing techniques and explore why modern auditing methods are essential to staying ahead of the curve.

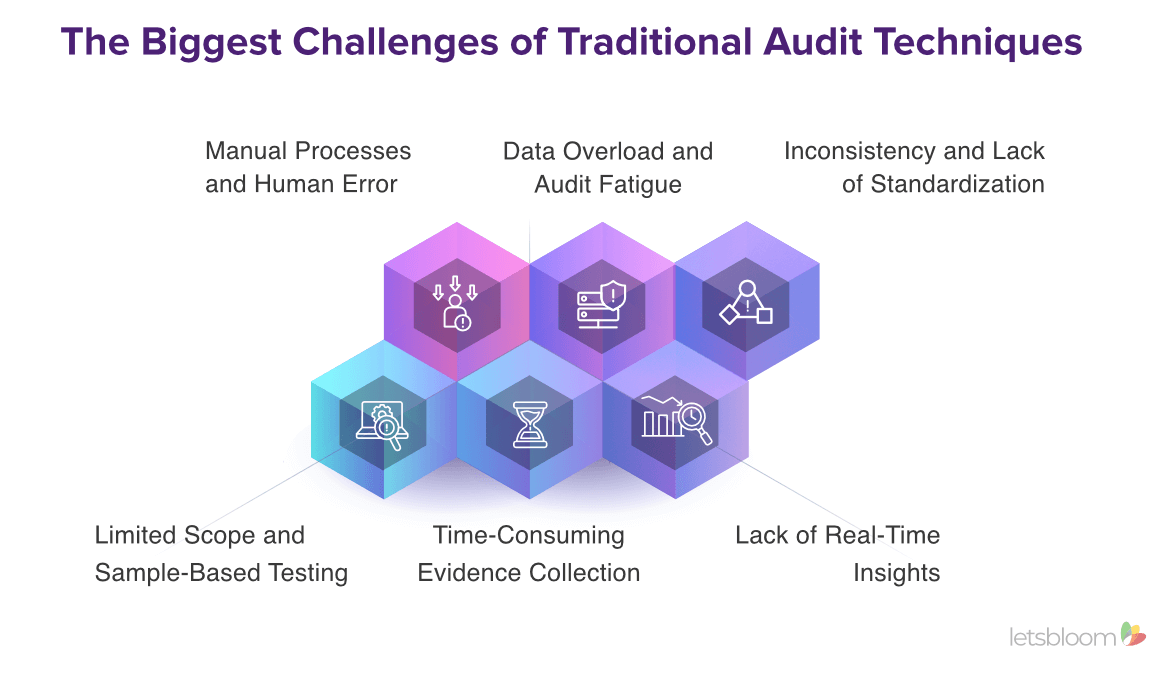

The Biggest Challenges of Traditional Audit Techniques:

1. Manual Processes and Human Error: Traditional audits heavily rely on manual processes inherently prone to human error. Auditors must sift through vast amounts of data, often using spreadsheets or other conventional tools. This approach is not only time-consuming but also requires specialized skills.

Human error, whether in data entry, calculation, or judgment, can compromise the integrity of the audit, leading to inaccurate findings and potential compliance risks. Moreover, the reliance on manual processes can strain resources, as organizations must allocate significant time and personnel to complete audits, often resulting in delayed outcomes.

2. Data Overload and Audit Fatigue: In today's digital age, the volume of data auditors must review has grown exponentially. This data overload can lead to audit fatigue, where the sheer amount of information becomes overwhelming, increasing the risk of critical issues being overlooked. Excessive data can also reduce audit quality, as auditors may need help identifying key insights amidst the noise.

3. Inconsistency and Lack of Standardization: One of the significant challenges of traditional audit techniques is the inconsistency in procedures and standards. Different auditors may apply varying methodologies, leading to inconsistencies in audit quality and difficulties in maintaining audit integrity. This lack of standardization can undermine the credibility of audits and make it easier to compare results across different periods or entities.

4. Limited Scope and Sample-Based Testing: Traditional audits often rely on sample-based testing, where a small subset of data is reviewed to infer the accuracy of the larger dataset. While this approach can be efficient, it carries significant risks.

Auditors may miss critical issues outside the sample by analyzing only a portion of the data, leading to incomplete or inaccurate conclusions. This limited scope can result in undetected compliance violations, financial discrepancies, or operational inefficiencies that could have been identified with more comprehensive testing.

5. Time-Consuming Evidence Collection: Collecting audit evidence in traditional audits is labor-intensive. Auditors must gather and verify documents, interview personnel, and perform detailed analyses to substantiate their findings. This process requires deep technical expertise and consumes significant time and resources.

Evidence collection can be time-consuming, delaying the audit process and leading to increased costs and prolonged uncertainty for the organization. In some cases, the delays associated with traditional audits can hinder timely decision-making as businesses wait for audit results to finalize their strategies or compliance efforts.

6. Lack of Real-Time Insights: Traditional audits are typically backward-looking, providing insights into past events rather than current risks. This retrospective approach limits the ability to provide real-time insights, which are increasingly crucial in today's dynamic business environment.

Real-time data can help an organization make timely decisions, respond to emerging risks, or capitalize on opportunities.

Conclusion

The challenges associated with traditional audit techniques have broad implications for businesses and auditors. As organizations grow in complexity and scale, the limitations of manual processes, data overload, and inconsistent standards become increasingly problematic. These challenges impact the efficiency and accuracy of audits and pose significant risks to compliance, financial integrity, and operational effectiveness.

To address these challenges, businesses must consider adopting modern auditing techniques like automation and AI-driven tools. These techniques can streamline audit processes, reduce human error, and provide real-time insights. By embracing these advancements, organizations can enhance their audit quality, ensure compliance, build trust, and gain a competitive edge.

Ready to put your audit journey on autopilot? Join forces with letsbloom and automate and accelerate your audit readiness journey 10x faster and 80% cheaper.