Internal Audits and Compliance: Two Sides of the Same Coin

Ritika Jain

Oct 23, 2024

How do you conduct an internal audit to stay compliant?

Internal compliance audits are crucial for maintaining organizational integrity and ensuring regulation compliance. They are key in identifying security and compliance gaps, improving internal controls and processes, and preventing non-compliance risks. Regular internal audits allow organizations to proactively manage risks, enhance operational efficiency, maintain continuous compliance, and build a strong brand reputation.

What is an Internal Compliance Audit?

An internal compliance audit involves systematically reviewing and assessing an organization's controls, processes, and procedures to ensure they comply with regulatory requirements and industry standards. The main objective of these audits is to evaluate the effectiveness of the organization's compliance program, identify potential areas of non-compliance, and recommend corrective actions to improve compliance posture.

Internal compliance audits are crucial for several reasons. They help in:

- Identifying compliance gaps that could lead to legal or financial penalties.

- Mitigating risks by addressing issues before they escalate.

- Enhancing operational efficiency by streamlining processes and ensuring they align with regulatory requirements.

- Promoting a culture of continuous improvement and accountability within the organization.

How Do Internal and External Compliance Audits Differ?

An organization's staff conducts internal audits, or an internal audit team evaluates internal controls, processes, and compliance with internal policies. In contrast, external audits are performed by independent third parties to provide an unbiased assessment of the organization's compliance with external regulations and industry standards.

While both types of audits are essential, they serve different purposes. Internal audits aim to identify and rectify issues internally, providing an opportunity for continuous improvement. External audits, on the other hand, validate the organization's compliance efforts, ensuring they meet regulatory standards and providing assurance to external stakeholders.

Internal audit reports drive internal improvements, while external audit reports are often required for regulatory compliance and demonstrate compliance to external stakeholders. Both reports are crucial in shaping the organization's compliance strategy and ensuring it remains aligned with industry standards and regulations.

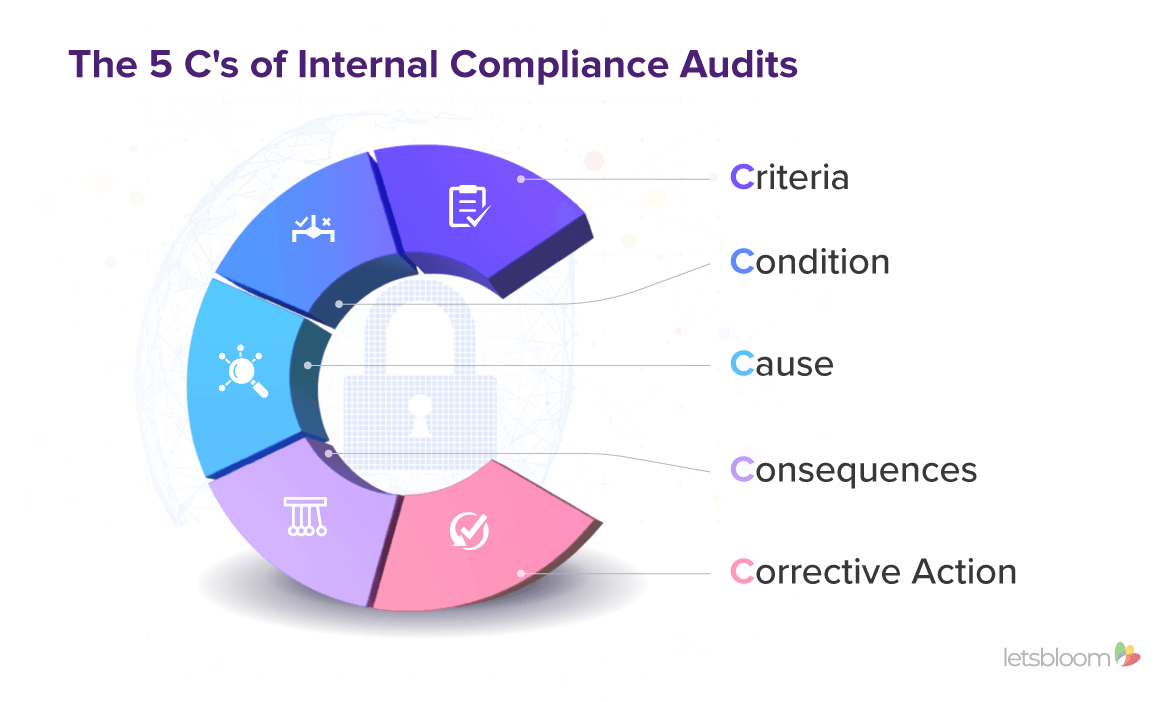

The 5 C's of Internal Compliance Audits

The 5 C's framework provides a structured approach to conduct internal compliance audits effectively:

1. Criteria: This explains which standards, regulations, or internal policies against which compliance will be measured. Clearly defining the criteria helps establish the scope and focus of the audit.

2. Condition: This outlines the current state of compliance within the organization. It involves assessing whether the organization is meeting the established criteria.

3. Cause: This highlights the root causes of any non-compliance issues. Causes may include process gaps, lack of awareness, or insufficient resources.

4. Consequences: This predicts the potential impacts of non-compliance to prioritize corrective actions. Consequences can range from legal penalties to reputational damage.

5. Corrective Action: This involves outlining the steps to address and rectify non-compliance issues. Corrective actions should be specific, measurable, and aimed at preventing recurrence.

How to Conduct an Internal Audit to Stay Compliant

Conducting an internal compliance audit requires meticulous preparation and planning. Here are the basic steps to conduct an internal audit with ease:

1. Determine the Audit Scope: Define the specific areas, processes, and regulations to be audited. This step involves identifying the particular aspects of the organization that will be reviewed and ensuring that the audit covers all relevant compliance areas.

2. Select an Internal Auditor: Choose qualified personnel with expertise and industry exposure. The auditor(s) should thoroughly understand the criteria being audited and be free from any conflicts of interest.

3. Prepare for the Audit: Gather relevant documents, policies, procedures, and other evidence that will be reviewed during the audit. Set realistic timelines and communicate the audit plan to appropriate stakeholders. Preparation is critical to ensuring a smooth audit process and obtaining accurate results.

4. Conduct the Audit: Perform the audit according to the defined scope and criteria, using appropriate methodologies such as interviews, document reviews, process observations, and testing of internal controls.

5. Create the Audit Report: Document the audit's findings, including compliance and non-compliance areas, and provide improvement recommendations. The audit report should be clear, concise, and actionable.

6. Remediate Nonconformities: Develop and implement action plans to address identified issues and prevent recurrence. This step is critical for ensuring that the organization remains compliant and continues to improve its processes.

Simplifying Internal Compliance Audits with Automation

Internal compliance audits can be time-consuming and resource-intensive, especially for large organizations or those operating in highly regulated industries. Automation can streamline the audit process, enhancing efficiency, reducing the team's burden, and minimizing the potential for human error. Compliance automation platforms can assist in evidence collection, data analysis, and reporting, enabling the team to focus on more strategic aspects of the audit.

With emerging technologies like AI poised to revolutionize the compliance landscape, automated compliance management platforms have the potential to make audits more predictive, adaptive, and efficient, enabling organizations to stay ahead of compliance challenges.

Partner with letsbloom today to experience the power of an AI-enabled Compliance Management Platform and fast-forward your audit journey!