Compliance Risk Management – Best Practices for Effective Risk Management

Ritika Jain

Oct 14, 2024

As global regulations proliferate, businesses of all sizes are exposed to greater compliance risk than ever. To resolve these, it is necessary to identify compliance risks, assess which risks have the most significant potential for legal, financial, operational, or reputational damage, and mitigate those risks promptly.

For early-stage organizations, understanding and managing compliance risks is about avoiding fines, building trust, ensuring business continuity, and maintaining a competitive edge in an increasingly regulated environment.

This blog post will guide you through the essentials of streamlining your compliance risk management process to navigate the complex regulatory landscape seamlessly.

What is Compliance Risk Management?

Compliance risk management is identifying, assessing, mitigating, and monitoring risks associated with regulatory compliance. It ensures businesses adhere to applicable laws, standards, and policies to avoid negative consequences.

Components of Effective Compliance Risk Management:

1. Risk Identification: This involves pinpointing potential compliance risks and gaps, whether they stem from regulatory changes, internal processes, or third-party relationships.

2. Risk Assessment: Once risks are identified, assessing their severity and likelihood is critical to prioritize efforts. This step helps businesses understand which risks could have the most significant impact.

3. Risk Mitigation: After assessment, remediation steps must be taken to minimize or eliminate risks. This can include implementing new policies, improving internal controls, investing in technology, or providing employee training.

4. Monitoring and Reporting: Continuous monitoring of compliance activities ensures that risk management strategies remain effective. Regular reporting helps businesses stay accountable and responsive to emerging threats.

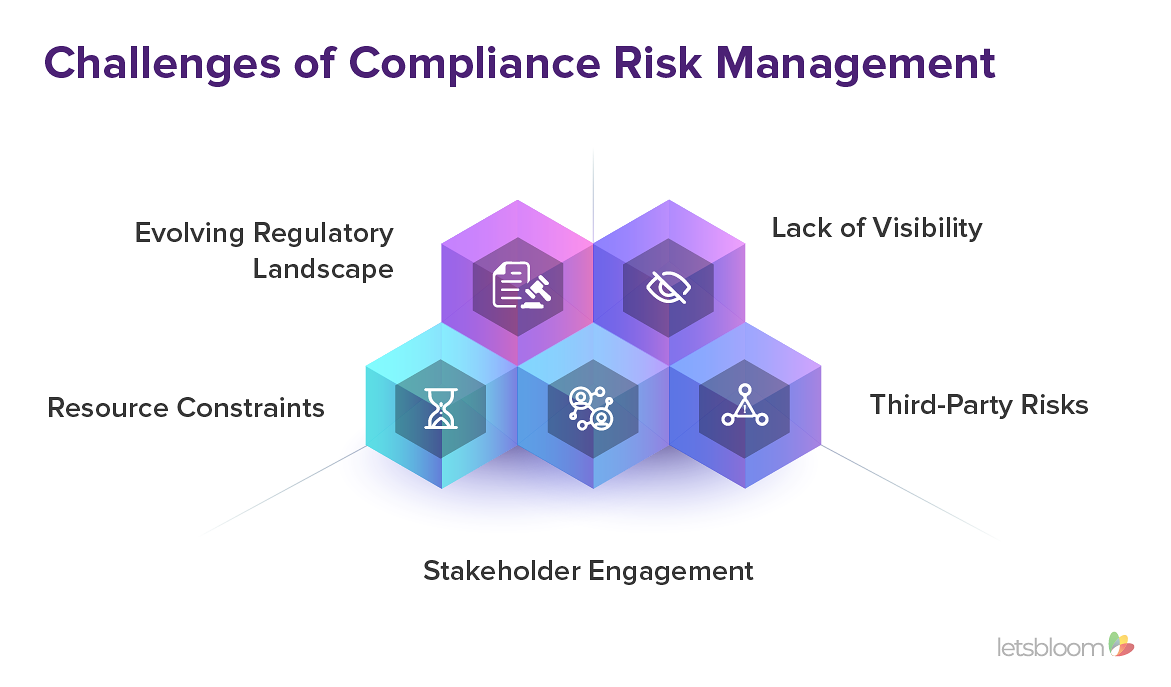

Challenges of Compliance Risk Management

While effective compliance risk management benefits are clear, startups and SMBs often face unique challenges in implementing robust strategies. Below are some of the most pressing challenges:

1. Evolving Regulatory Landscape: The regulatory environment constantly changes, with new laws and standards introduced regularly. Keeping pace with these updates can be particularly overwhelming for smaller businesses, leading to unintentional non-compliance.

2. Resource Constraints: Startups and SMBs often operate with tight budgets and lean teams. This lack of resources usually leads to gaps in compliance risk management, as dedicated compliance teams may not exist.

3. Stakeholder Engagement: Achieving buy-in from all stakeholders, including employees, management, and board members, can be challenging, especially when the benefits are not immediately tangible. Compliance efforts may need more support to be effective with active participation.

4. Third-Party Risks: Startups and SMBs frequently rely on third-party vendors for various services, which introduces additional compliance risks. Managing these external risks adds another layer of complexity to compliance efforts.

5. Lack of Visibility: Small businesses may need help maintaining complete visibility over compliance-related activities with numerous moving parts. This lack of oversight can lead to potential blind spots in risk management and missed regulatory requirements.

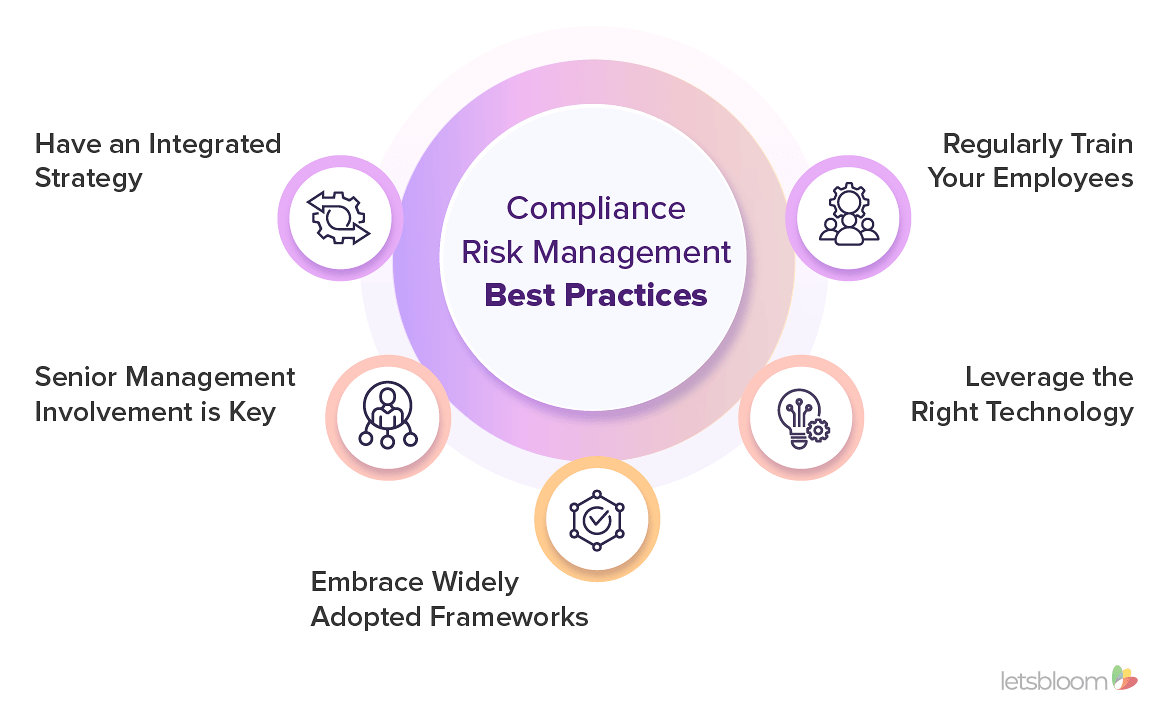

5 Best Practices for Effective Compliance Risk Management

Despite these challenges, businesses can implement effective compliance risk management strategies by following these best practices:

1. Have an Integrated Strategy: Compliance risk management should be woven into the fabric of your organization. By adopting a holistic approach, businesses can integrate compliance into every function. Concepts like Compliance-as-code and shift-left approaches allow organizations to embed compliance checks early in the development process rather than being an afterthought.

2. Senior Management Involvement is Key: Senior leadership must actively support and participate in compliance efforts to foster a culture of compliance across the organization. By understanding that regulatory adherence is a shared responsibility, businesses can ensure a more significant commitment to compliance goals.

3. Embrace Widely Adopted Frameworks: By adhering to recognized frameworks like SOC 2 or ISO 27001, businesses can demonstrate their commitment to compliance and gain client and partner trust. These frameworks provide a strong foundation for building robust compliance systems and can help unlock new business opportunities by demonstrating commitment to security and governance.

4. Leverage the Right Technology: Compliance automation platforms can significantly reduce the manual burden of compliance risk management. These platforms offer continuous monitoring, real-time observability, accurate reporting, and smarter risk management, enabling businesses to remain compliant with the ever-changing regulatory landscape.

5. Regularly Train Your Employees: Employees are often the first defense against compliance risks. Regular training and workshops help keep them informed about evolving regulations and internal policies. Encouraging continuous learning ensures that compliance becomes a natural part of everyday operations, reducing the risk of non-compliance.

Conclusion

Today’s highly regulated business landscape is a complex web of regulatory benchmarks, industry standards, and guidelines. And without a proper compliance risk management solution, navigating this regulatory landscape can be overwhelming.

letsbloom offers an AI-driven risk management solution that integrates into your tech stack, automating end-to-end workflows to identify, assess, and monitor compliance issues 10x faster and 80% cheaper. It features a risk library with pre-mapped controls for all major regional and global regulations including SOC 2, ISO, NIST, PCI DSS, HIPAA, and more, helping businesses effectively manage risks across multi-framework compliance environment.

To learn more about compliance automation and risk management, talk to our experts.